This article is written by Silvia M Jacob, BA LLB. 5th year at Kristu Jayanti College of Law, Bangalore, during her internship at LeDroit India

Introduction

In today’s rapidly digitising world, the transition from paper-based to electronic processes has revolutionised how businesses and individuals conduct transactions. Such a transformation lies in the concept of digital signatures, which have emerged as a cornerstone of modern digital commerce and legal documentation. Digital signatures represent far more than mere technological convenience. They embody a shift in how we secure and legally validate electronic documents and transactions in an increasingly interconnected global economy.

Unlike traditional handwritten signatures that can be easily forged or replicated, digital signatures utilise sophisticated cryptographic technologies to provide the needed authentication. This innovation has become crucial as organisations worldwide embrace remote work, a digital mode of business, and paperless operations. The global e-signature market, valued between $2.3 billion and $2.8 billion in 2020, is projected to reach $13.4 billion by 2030, representing a remarkable 26.7% compound annual growth rate.

The legal recognition and widespread adoption of digital signatures across different jurisdictions have created new paradigms for conducting business, executing contracts, and maintaining regulatory compliance. From India’s Information Technology Act, 2000, to the United States’ ESIGN Act, and the European Union’s eIDAS Regulation, legal frameworks worldwide have evolved to accommodate and validate digital signatures as legally binding instruments equivalent to traditional wet-ink signatures.

Synopsis

Understanding the Technology Behind Digital Signatures

Blockchain Integration and Modern Developments

Legal Framework and Regulatory Compliance

Industry Applications and Use Cases

Recent Developments and News

Artificial Intelligence Integration

Challenges and Future Outlook

Technological Innovation and Integration

Conclusion

Understanding the Technology Behind Digital Signatures:

The technological sophistication of digital signatures stems from their reliance on Public Key Infrastructure (PKI), which serves as the backbone for strong digital communications. PKI encompasses a comprehensive framework of policies, procedures, hardware, software, and standards required to create, manage, distribute, use, Store, and revoke virtual certificates.

At its core, PKI operates on the principle of asymmetric cryptography, utilising mathematically related key pairs consisting of a private key (kept secret by the owner) and a public key (freely distributed to others). When a user creates a digital signature, they employ their private key to encrypt a cryptographic hash of the document, producing a unique digital fingerprint that serves as the signature. Recipients can then use the signer’s public key to decrypt and verify the signature, confirming both the document’s Integrity and the signer’s identity.

The signing process involves several critical steps that ensure security and authenticity. Initially, the document undergoes hashing using cryptographic functions such as SHA-256, creating a unique digital fingerprint of the content. The signer’s private key then encrypts this hash value, generating the digital signature. The original document, combined with the digital signature and the signer’s digital certificate (containing the public key), forms a complete package that can be verified by recipients.

Certificate Authorities (CAs) play a pivotal role in this ecosystem by serving as trusted third parties that validate the identity of entities requesting digital certificates. In India, the Controller of Certifying Authorities (CCA) oversees licensed CAs that issue Digital Signature Certificates under the IT Act’s provisions. These certificates establish a chain of trust, enabling recipients to verify that a public key genuinely belongs to the claimed signer.

Blockchain Integration and Modern Developments:

The convergence of digital signatures with blockchain technology represents a significant advancement in secure authentication systems. Blockchain networks rely heavily on digital signatures to validate transactions and maintain network integrity. In cryptocurrency systems like Bitcoin and Ethereum, digital signatures authenticate transaction authorisations while preventing double-spending and unauthorised transfers.

Blockchain-based digital signatures utilise specialised algorithms such as the Elliptic Curve Digital Signature Algorithm (ECDSA) and Edwards-curve Digital Signature Algorithm (EdDSA). These algorithms provide enhanced efficiency and security compared to traditional RSA-based systems while maintaining smaller key sizes. The Schnorr Digital Signature Algorithm, implemented in Bitcoin’s Taproot upgrade, offers additional benefits, including signature aggregation capabilities that enhance privacy and efficiency.

The integration of digital signatures with blockchain technology addresses several key challenges in traditional centralised systems. Blockchain’s distributed nature eliminates single points of failure while providing immutable audit trails for all signature-related activities. Smart contracts can automatically execute based on verified digital signatures, enabling sophisticated automated agreements without requiring trusted intermediaries.

Legal Framework and Regulatory Compliance:

Indian Legal Framework

India’s approach to digital signature regulation demonstrates a comprehensive understanding of the technology’s potential and challenges. The Information Technology Act, 2000, provides the foundational legal framework, with Section 5 granting legal recognition to digital Signatures primarily based on uneven cryptosystems. The Act defines digital signatures as authentication of any electronic record by a subscriber utilising an electronic method or procedure under the provisions of section 3.

The legal framework encompasses several key components that ensure digital signatures’ validity and enforceability. Section 3 of the IT Act specifies the technical requirements for creating valid digital signatures, mandating the use of asymmetric cryptosystem technology and hash functions. Section 10A affirms the validity of contracts formed through electronic means, provided they satisfy all contractual conditions, establishing virtual signatures as legally equal to handwritten signatures.

India’s regulatory structure includes specialised entities responsible for maintaining the digital signature ecosystem’s integrity. The Controller of Certifying Authorities (CCA) oversees the licensing and regulation of Certifying Authorities. Licensed CAs must adhere to strict standards and procedures when issuing Digital Signature Certificates, ensuring the authenticity and Reliability of the certification process.

Recent developments in Indian digital signature law include the introduction of Aadhaar-based eSign services, which leverage India’s unique biometric identification system to enable electronic signatures. The Information Technology (Use of Electronic Records and Digital Signature) Rules, 2004 and the Electronic Authentication Technique Rules, 2015, provide detailed technical specifications for implementing various electronic signature methods.

International Legal Frameworks

The global landscape of digital signature regulation reflects diverse approaches while maintaining common principles of security, authenticity, and legal equivalence. The United States pioneered digital signature legislation with the Electronic Signatures in Global and National Commerce Act (ESIGN) in 2000, establishing federal recognition for electronic signatures in interstate and foreign commerce. The Uniform Electronic Transactions Act (UETA), adopted by 49 states, provides consistent rules for implementing electronic signatures across state boundaries.

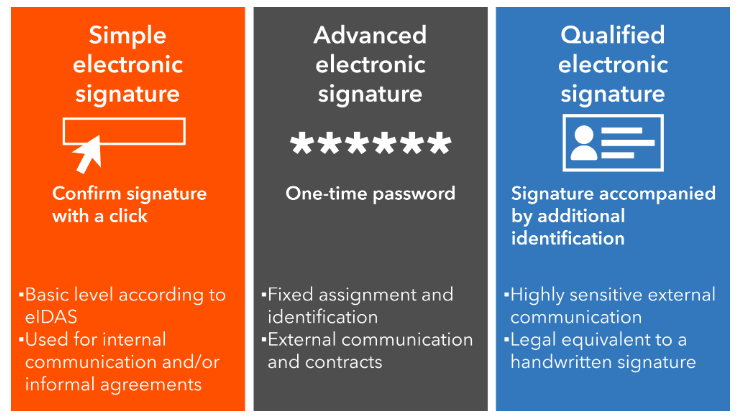

European Union regulations, particularly the eIDAS Regulation, establish one of the world’s most comprehensive frameworks for electronic identification and trust services. The eIDAS 2.0 framework, effective as of May 20, 2024, introduces enhanced security requirements and the European Digital Identity (EUDI) Wallet system. This updated regulation mandates stricter authentication protocols for Qualified Electronic Signatures (QES), which carry the same legal weight as handwritten signatures throughout all EU member states.

The United Kingdom maintained its electronic signature framework post-Brexit through domestic legislation that mirrors eIDAS principles. The UK’s approach emphasises a permissive stance toward electronic signatures, with industry working groups noting that “electronic signatures are in many ways better and more secure than traditional methods, and should be the norm rather than the exception”.

Asia-Pacific countries have developed their digital signature frameworks tailored to local needs and technological capabilities. Singapore’s Electronic Transactions Act and Australia’s Electronic Transactions Act provide comprehensive legal foundations for electronic signatures while maintaining technology-neutral approaches that accommodate evolving cryptographic methods.

Industry Applications and Use Cases

The financial services sector is leading the adoption of digital signature technology due to regulatory requirements, security needs, and the hunt for operational efficiency. Banks use digital signatures for various processes, such as loan processing and investment agreements, as they enhance security and substantially lessen transaction times.

JPMorgan Chase implemented digital signature systems for online account management and loan applications, cutting transaction processing times from days to hours and boosting customer satisfaction. In India, HDFC Bank adopted digital signatures for personal loans, integrating them with Aadhaar-based eSign services to slash processing times from weeks to minutes while ensuring compliance with regulations.

In Europe, financial institutions use eIDAS-compliant digital signatures for cross-border transactions. Deutsche Bank employs Qualified Electronic Signatures (QES) for high-value deals and regulatory submissions, ensuring adherence to European Banking Authority standards.

Healthcare and Medical Records

The healthcare industry faces challenges with digital signature implementation due to strict privacy regulations and the sensitive nature of medical information. Digital signatures facilitate secure processes like e-prescribing and patient consent management, ensuring document integrity and regulatory compliance. Mayo Clinic in the U.S. has implemented a digital signature system for patient intake and medical record authentication, integrating it with their electronic health record (EHR) system. This has improved patient satisfaction by reducing paperwork and speeding up appointment processing.

In India, Apollo Hospitals uses digital signatures for patient registration and insurance claims, complying with healthcare regulations and improving data security while reducing administrative processing times by 60%. In Europe, eIDAS-compliant digital signatures aid cross-border cooperation in patient care, as seen in Charité Universitätsmedizin Berlin, which employs qualified electronic signatures for clinical trials and research collaborations, ensuring compliance across jurisdictions.

Real Estate and Property Transactions:

Real estate transactions can be complex, but digital signatures greatly simplify the documentation process. Traditionally, property purchases and leases required extensive paperwork and in-person meetings. Digital signatures streamline these processes while ensuring legal validity and security. In the U.S., Zillow Group has transformed residential real estate by integrating digital signatures, allowing buyers, sellers, and agents to complete transactions online. This innovation reduced average closing times from 45 to 30 days and improved transaction transparency. In India, Brigade Group adopted digital signatures for apartment sales and property registration, complying with the Registration Act and facilitating seamless property transfers. Customers benefit from increased convenience and lower transaction costs.

In Europe, eIDAS-compliant digital signatures support cross-border property investments. Engel & Völkers uses Advanced Electronic Signatures for purchase agreements and rental contracts across multiple countries, ensuring legal validity and enforceability.

Recent Developments and News:

The year 2025 marks a significant year for digital signature regulatory evolution, with multiple jurisdictions implementing enhanced requirements and new compliance frameworks. In the United Kingdom, HMRC introduced mandatory Advanced Electronic Signature requirements effective April 6, 2025, for agents receiving income tax and PAYE repayments on behalf of clients. This change mandates that agents use electronic signature solutions that are “uniquely linked to the person signing,” provide “sole control of signature data,” and can “detect any changes made to signature data afterwards”.

The European Union’s eIDAS 2.0 implementation continues through 2025, with member states gradually adopting enhanced security requirements and European Digital Identity (EUDI Wallet) systems. The updated regulation introduces stricter authentication protocols for Qualified Electronic Signatures and establishes standardised verification processes across EU member states. Organisations must prepare for increased security requirements and ensure their digital signature systems comply with the evolving regulatory landscape.

Artificial Intelligence Integration

The integration of Artificial Intelligence and Machine Learning technologies with digital signatures represents one of the most significant recent developments in the field. AI-powered signature verification systems can analyse signing behaviour patterns, detect fraudulent activities, and provide enhanced authentication mechanisms that surpass traditional verification methods.

Progressive companies are implementing AI-driven signature analysis that establishes baseline signing behaviours for individual users, enabling real-time fraud detection when signatures deviate from established patterns. Biometric pattern recognition technologies incorporate typing rhythm, mouse movement patterns, and facial recognition data to create comprehensive user authentication profiles.

Machine learning algorithms can process millions of signature parameters to identify subtle anomalies that may indicate forgery or tampering. These systems continuously learn from new signature data, improving their accuracy and fraud detection capabilities over time. The technology’s ability to analyse vast amounts of signature data enables predictive analytics that can identify potential security threats before they occur.

Industry Adoption Trends

2025 industry data reveals accelerating adoption rates across multiple sectors, with 78% of law firms now utilising electronic signature tools as part of their standard operations. The legal industry’s embrace of digital signatures reflects growing confidence in the technology’s security and legal validity, particularly following successful implementation during the COVID-19 pandemic. Healthcare sector adoption continues to expand, though at a slower pace than financial services and legal industries. Privacy regulations and complex compliance requirements create implementation challenges, but organisations increasingly recognise digital signatures’ benefits for patient Care coordination, regulatory compliance, and operational efficiency.

Small and medium-sized businesses represent the fastest-growing segment of digital signature adoption, with cloud-based solutions enabling cost-effective implementation without significant infrastructure investments. These businesses benefit from reduced administrative costs, improved customer experiences, and enhanced compliance capabilities through digital signature implementation.

Challenges and Future Outlook

Despite significant technological advances, digital signatures face ongoing security challenges that require continuous attention and innovation. Quantum computing threats represent the most significant long-term challenge, potentially compromising current cryptographic foundations. Organisations must balance current security needs with future-proofing strategies that ensure continued protection as quantum technologies mature.

Identity verification remains a critical challenge, particularly for high-value transactions and regulated industries. While current systems provide robust authentication, evolving attack methods require continuous improvement in verification protocols and fraud detection capabilities. Biometric integration and multi-factor authentication systems offer enhanced security but introduce additional complexity and privacy considerations.

Cross-border recognition and interoperability present ongoing challenges as different jurisdictions maintain varying technical standards and legal requirements. Organisations operating internationally must navigate multiple regulatory frameworks while ensuring consistent security and legal validity across different markets.

Technological Innovation and Integration

Blockchain integration continues evolving as organisations explore distributed ledger technologies for enhanced security and transparency. Smart contract integration enables automated execution of agreements based on verified digital signatures, reducing operational complexity and improving transaction efficiency.

The Internet of Things (IoT) integration presents new opportunities and challenges for implementing digital signatures. Connected devices require lightweight cryptographic protocols that maintain security while operating within resource constraints. Edge computing and distributed signature generation capabilities enable new applications while maintaining security standards. Cloud-based digital signature services continue expanding, offering organisations cost-effective implementation options with enhanced scalability and accessibility. However, cloud deployment introduces additional security considerations related to data sovereignty, privacy protection, and regulatory compliance across different jurisdictions.

Conclusion

Digital signatures have become crucial in today’s digital world, changing how businesses operate and sign agreements. Supported by laws like India’s IT Act and the EU’s eIDAS Regulation, they offer a secure and valid alternative to paper signatures. Innovations in AI, blockchain, and future-proof security ensure their continued relevance. Sectors like finance and healthcare show digital signatures’ versatility, enhancing efficiency and customer satisfaction. As technology advances, digital signatures will adapt, creating secure and trusted digital interactions. Embracing these changes will help organisations stay competitive and contribute to a secure digital environment.

References: