This article is written by Mansi Rathi, B.A. LLB (4th Year), Shankarrao Chavan Law College during her internship at LeDroit India.

Keywords: Preference Shares, Equity Shares, Dividend Rights, Voting Rights, Redemption, Share Capital, Company Law, Shareholder Rights

Abstract

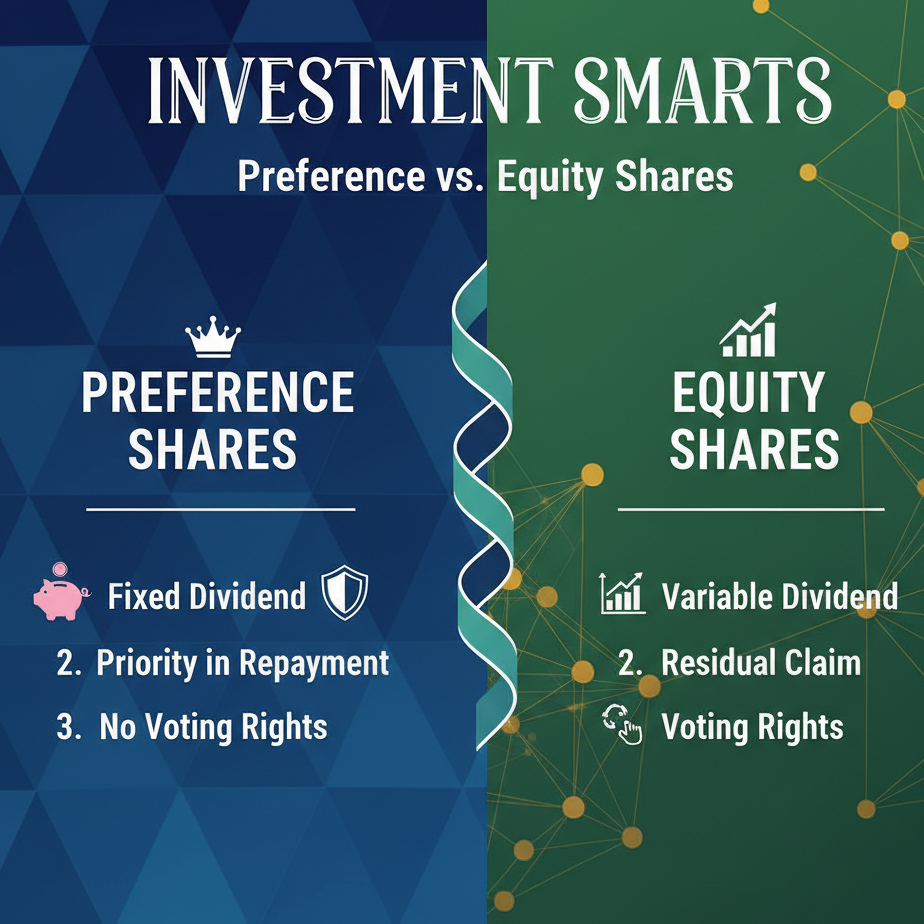

Preference shares and equity shares form the backbone of a company’s capital structure. The difference between preference shares and equity shares is not just a technical distinction but carries crucial implications for dividend rights, voting control, risk appetite, and investor preferences. Equity shareholders are owners of the company with voting rights and the potential for high returns, while preference shareholders enjoy fixed dividends and priority in case of liquidation. This article delves deep into the definitions, legal framework, types, advantages, disadvantages, illustrations, case laws, taxation, global comparisons, practical significance, capital structuring, emerging trends, investor strategies, and critical analysis that define and differentiate these two instruments. The comparison is crucial for corporate governance, investment strategy, and regulatory compliance in modern corporate law.

Introduction

In the ever-evolving landscape of corporate finance, companies raise capital to fund operations, expansion, or innovation by offering ownership interests in the form of shares. Among the various instruments available for this purpose, preference shares and equity shares serve as the primary building blocks of a company’s capital structure. These two classes of shares differ significantly in terms of rights, obligations, and risk exposure—differences that are central to understanding corporate governance, shareholder dynamics, and strategic investment decisions.

Equity shares, also known as ordinary shares, confer ownership rights to shareholders. Equity shareholders typically have voting rights and are entitled to a share in the profits of the company in the form of dividends, though these are not guaranteed. In contrast, preference shares are designed to provide a fixed return to shareholders and carry preferential rights over equity shares when it comes to dividend payments and repayment of capital during liquidation. However, preference shareholders usually do not possess voting rights, and their role in management is limited.

The classification of share capital into preference and equity shares plays a significant role in defining the structure and governance of modern corporations. Investors choose between equity and preference shares based on their investment horizon, risk appetite, and income expectations. For companies, issuing the right mix of shares is crucial to maintaining control, ensuring liquidity, and adhering to compliance norms.

This article provides a detailed and analytical exploration of the difference between preference shares and equity shares, covering legal definitions, dividend rights, voting power, capital structuring, risk factors, taxation, global comparisons, real-world examples, and landmark judgments. By addressing both theoretical distinctions and practical implications, the article serves as a holistic guide for law students, legal professionals, corporate managers, and investors.

To understand the distinction between preference and equity shares more comprehensively, it’s crucial to consider a multi-dimensional analysis that includes not only legal definitions and rights but also financial, strategic, operational, and risk-based criteria.

Legal Framework under Companies Act, 2013

The Companies Act, 2013, along with associated rules and SEBI regulations, https://indiankanoon.org/doc/1365176/governs the issuance, rights, redemption, and classification of equity and preference shares.https://ledroitindia.in/product/company-laws-in-india-certificate-course/

Section 43:

- Classifies share capital into equity and preference shares.

- Equity shares may carry voting rights or differential rights.

- Preference shares offer preferential dividend and repayment during winding up.

Section 55:

- Provides the rules for redeemable preference shares.

- Prohibits issuance of irredeemable preference shares.

- Allows redemption out of profits or a fresh issue of shares.

Rule 9 of the Companies (Share Capital and Debentures) Rules, 2014:

- Allows infrastructure companies to issue preference shares redeemable after 20 years.

SEBI (ICDR) Regulations, 2018:

- Prescribes conditions and disclosures for listed companies issuing preference shares.

FEMA and RBI Regulations:

- Apply to foreign investors in Indian companies issuing preference shares (e.g., CCPS).

Types of Equity and Preference Shares

Equity Shares:

- Ordinary Shares: Standard shares with one vote per share.

- DVR Shares: Equity shares with Differential Voting Rights.

- Bonus Shares: Issued from profits to existing shareholders.

- Rights Shares: Offered to existing shareholders at a discount.

- ESOPs: Granted to employees for retention and performance.

- Sweat Equity Shares: Issued to employees or directors for value addition.

Preference Shares:

- Cumulative: Dividends accumulate if unpaid.

- Non-Cumulative: No carry forward of unpaid dividends.

- Participating: Entitled to surplus profits post fixed dividend.

- Non-Participating: Limited to fixed dividend only.

- Convertible: Can be converted into equity after a certain period.

- Non-Convertible: Remain as preference shares permanently.

- Redeemable: Must be redeemed within 20 years.

Core Differences: Legal, Strategic, and Practical Angles

To understand the distinction between preference and equity shares more comprehensively, it’s crucial to consider a multi-dimensional analysis that includes not only legal definitions and rights but also financial, strategic, operational, and risk-based criteria.

Financial Perspective

Equity shares represent ownership and have potential for appreciation, while preference shares are akin to fixed-income instruments. Companies use preference shares as a hybrid between debt and equity to manage costs and preserve control. From an investor’s viewpoint, preference shares provide steady returns but lack upside participation during high-profit years.

Corporate Control and Voting Impact

Voting rights distinguish equity shareholders as active participants in corporate governance. Preference shareholders, generally devoid of such rights, are passive investors unless their rights are triggered by non-payment of dividends for consecutive years (as per Section 47 of the Companies Act, 2013). This becomes a strategic decision for promoters during fundraising — opting for capital without losing control.

Risk and Security Considerations

In liquidation scenarios, preference shareholders rank higher in priority than equity shareholders but still fall behind secured creditors. They offer a safer investment option compared to equity but carry higher risk than debt instruments.

Issuance and Redemption Procedures

Equity shares are perpetual in nature. In contrast, preference shares are issued with clear redemption terms, often requiring regulatory compliance under Section 55. The redemption process must involve either distributable profits or proceeds from a fresh issue.

Accounting Treatment

From a financial reporting standpoint, preference shares may sometimes be treated as liabilities (if redeemable with mandatory terms), affecting debt-equity ratios, while equity capital always forms part of net worth.

Real-Life Examples

Example 1: Dividend Scenario

Reliance Ltd. declares a ₹10 crore dividend. Preference shareholders (₹2 crores at 10%) receive ₹20 lakhs first. The remaining ₹9.8 crores are distributed among equity shareholders.

Example 2: Convertible Preference Shares

Investors in Paytm’s early funding rounds were issued CCPS, converting into equity when the company was listed.

Example 3: Redemption Process

Tata Capital issued redeemable preference shares in 2012, redeemed them in 2022 using proceeds from a fresh issue, fulfilling Companies Act norms

Strategic and Capital Structuring Importance

Preference shares are strategic tools for raising funds without diluting promoter control. They are especially useful in: – Pre-IPO investments. – Debt restructuring. – Capital raising for infrastructure projects. – Compliance with Tier-I capital norms (banks).

Hybrid capital frameworks often blend equity, debt, and preference shares.

Investor Psychology and Market Behavior

Equity shares attract risk-tolerant investors aiming for long-term capital growth. Preference shares attract conservative investors who seek fixed income. Market trends show increasing interest in DVRs and CCPS among tech startups and new-age investors

Tax and Compliance Perspective

| Parameter | Equity Shares | Preference Shares |

|---|---|---|

| Dividend Tax | Taxable in hands of holder | Same |

| Capital Gains | LTCG/STCG based on period | Not usually applicable |

| TDS | No | Applicable if structured as debt-like |

Illustrative Judicial Commentary and Regulatory Insight

Case Law: Gujarat Industrial Investment Corp. Ltd. v. Commissioner of Income Tax (1995)

Held that dividend on preference shares is not deductible from taxable profits, emphasizing their classification as equity in essence despite fixed returns.

Case Law: Needle Industries v. Needle Industries Newey (India) Holding Ltd. (1981)

Reiterated that any differentiation in shareholder rights must be declared transparently in Articles of Association.

SEBI Regulations

The SEBI ICDR regulations require listed entities to disclose shareholding pattern distinguishing equity and preference classes, to promote transparency in ownership.

MCA Circulars

Recent MCA clarifications in 2020 emphasized accounting standards for convertible preference shares under Indian Accounting Standard (Ind AS) 32, reinforcing disclosure norms.

Preference Shares in Indian Banking and NBFC Sector

Banks and Non-Banking Financial Companies (NBFCs) have increasingly used preference shares to meet capital adequacy norms.

- Tier-I and Tier-II capital: RBI permits inclusion of perpetual preference shares under Tier-I capital.

- Basel III Norms: Preference instruments can be used to strengthen capital buffers, aiding systemic stability.

Examples:

- SBI raised ₹3,000 crores through non-convertible preference shares in 2021.

- HDFC Ltd. issued redeemable non-convertible preference shares to institutional investors to support credit expansion.

These instruments provide funding flexibility while ensuring regulatory compliance.

Investor Perspective: How to Choose?

When to Choose Equity Shares:

- Long-term capital appreciation.

- Desire for voting rights.

- Ability to tolerate risk.

When to Choose Preference Shares:

- Need for fixed income.

- Preference for capital protection.

- Passive investment with assured returns.

Investor Caution:

Preference shares can carry call and put options, convertibility terms, or step-up clauses. It’s essential for investors to read offer documents carefully and understand implications on capital gains, dividend tax, and conversion timelines.

Emerging Trends and Innovation in Hybrid Securities

With dynamic shifts in the global financial ecosystem, hybrid securities are becoming popular. These include instruments that combine features of equity, preference shares, and debt. Examples include:

- Perpetual Bonds: Have no maturity date and pay interest like preference dividends.

- Masala Bonds: Issued by Indian companies in foreign markets, sometimes structured with convertible rights.

- Hybrid Convertible Instruments (HCIs): Used in start-up fundraising, offering flexibility in conversion and rights.

Indian regulators are gradually adapting to support innovation while ensuring transparency and investor protection.

Preference Shares in Startups and Private Companies

Startups often use Compulsorily Convertible Preference Shares (CCPS) to secure investments without immediately giving up equity. This helps balance the interests of founders and early investors.

Key Characteristics of CCPS in Startups:

- Convert after a liquidity event (IPO, acquisition).

- Include anti-dilution clauses.

- Provide liquidation preference.

- Carry board representation rights.

This structure ensures capital infusion while protecting investors from high risk, especially in the early stages.

The Role of Equity and Preference Shares in ESG Financing

With the rise of Environmental, Social and Governance (ESG) mandates, companies are using tailored financial instruments to support sustainable initiatives.

- Green Preference Shares: Issued specifically for ESG-compliant projects.

- Equity Shares under Impact Investment Models: Attract socially conscious investors with dual goals of profit and impact.

ESG-aligned securities must be clearly structured, monitored, and disclosed as per global reporting standards.

Comparative Study: Equity and Preference Shares in Global Jurisdictions

| Jurisdiction | Equity Share Features | Preference Share Features |

|---|---|---|

| USA | One-share-one-vote, SEC regulated | Widely used with convertible features |

| UK | Strong shareholder rights | Participating preference shares common |

| Singapore | Allow non-voting shares | Hybrid instruments encouraged |

| Canada | Dual-class structures allowed | Resettable and retractable preferred shares |

This comparative view shows India has scope to innovate further, taking cues from global markets.

Conclusion

The difference between preference shares and equity shares is deeply embedded in the structure of company law and investment theory. While equity shares bring control and potential for appreciation, preference shares offer safety and income.

From dividend priority to voting rights, from capital appreciation to liquidity, these distinctions shape strategic choices for investors and corporations alike. In today’s era of financial engineering, companies and investors must align their objectives with the right mix of equity and preference capital.

Moreover, with trends such as ESG financing, startup-focused securities, and global innovation in share structures, the relevance of understanding these differences grows even more critical.

In conclusion, the difference between preference shares and equity shares is not only a theoretical divide but a practical strategy shaping corporate finance, governance, and regulatory evolution. A deep understanding of both types of shares enables better legal structuring, compliance management, and investment clarity.