Author- Sakshi Tripathi

Abstract

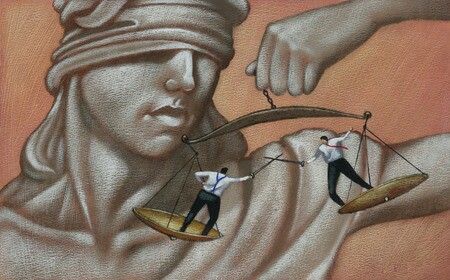

The Jet Airways Etihad Airways investment deal was a landmark transaction in India’s aviation sector, representing the first instance of a foreign airline investing in an Indian carrier under the liberalised Foreign Direct Investment (FDI) norms. This deal not only had commercial implications but also raised regulatory and legal concerns that culminated in a detailed examination by the Competition Commission of India (CCI). The review focused on the nature of control, potential anti competitive outcomes, and broader implications on international aviation routes. This article explores the factual background, legal frameworks, CCI’s review process, divergent views within the Commission, and the precedent this case set for future FDI transactions in India’s strategic sectors.

Introduction

In the complex and highly regulated environment of civil aviation, strategic investments and international partnerships often serve as lifelines for struggling carriers. One such pivotal transaction in India’s aviation history was the strategic equity investment by Etihad Airways in Jet Airways. Announced in April 2013 and valued at approximately ₹2,058 crore, the deal marked the first-ever foreign direct investment (FDI) by a foreign airline into an Indian carrier under newly liberalised aviation sector norms. The investment was not merely financial—it was designed as a comprehensive strategic alliance encompassing joint management, coordination of routes, and sharing of operational resources.

The transaction took place in the backdrop of mounting financial distress in the Indian aviation sector, especially among private carriers. Jet Airways, once a market leader, had been suffering severe losses, rising debt, and intense competition from low-cost carriers. The 2012 policy change by the Government of India allowing up to 49% FDI in Indian airlines by foreign carriers opened the doors to such much-needed international capital inflows. Etihad’s investment was not only expected to revive Jet Airways but also aimed to strengthen Etihad’s position in South Asia, using India as a key transit hub to feed its Abu Dhabi network.

However, what made this deal truly significant was not just its novelty or commercial importance but the legal and regulatory scrutiny it attracted. The Competition Commission of India (CCI), under the Competition Act, 2002, undertook a detailed review to assess whether the deal would lead to an appreciable adverse effect on competition (AAEC) in the Indian aviation market. The CCI’s investigation extended far beyond the numeric stake of 24% held by Etihad; it examined the real nature of control, influence over strategic decisions, and the potential anticompetitive consequences of the strategic collaboration.

The deal also raised concerns before multiple regulators including the Securities and Exchange Board of India (SEBI) and the Ministry of Civil Aviation, and even invited scrutiny from competition regulators in other jurisdictions such as Singapore. Among the issues were: whether Etihad’s rights amounted to “joint control” despite minority shareholding, whether this triggered a mandatory open offer under SEBI regulations, and whether this strategic tie-up could lead to market foreclosure for competing airlines.

Perhaps most significantly, the deal tested how Indian regulatory bodies interpret concepts like “control,” “combination,” and “strategic influence” in cross-border investments—concepts that are often blurred in the modern M&A landscape, especially in asset-light industries like aviation, where branding, code-sharing, and route management are more critical than shareholding percentages.

This article critically analyses the entire lifecycle of the Jet–Etihad deal through the lens of competition law and corporate regulation. It traces the factual timeline, explores the CCI’s order and its legal rationale, dissects the dissenting opinion within the CCI, and evaluates how this case has impacted future foreign investment structuring in India. As India continues to evolve into a more open economy while maintaining regulatory oversight over strategic sectors, this case stands as a vital reference point in understanding the intricate balance between investment facilitation and market fairness.

Legal Framework

A. Competition Act, 2002

∙ Promote and sustain competition in markets;

∙ Protect the interests of consumers;

∙ Ensure freedom of trade carried on by other participants.

Under Section 5 and 6 of the Act:

∙ CCI has the authority to approve, modify, or block combinations based on their competitive effects.

B. FDI Policy

According to the 2012 amendment:

∙ The control and effective ownership were expected to remain with Indian promoters to preserve national security and aviation sovereignty.

Background of the Deal

In April 2013, Jet Airways and Etihad Airways signed a strategic investment agreement under which: ∙ Etihad would purchase a 24% stake in Jet Airways for ₹2,058 crore.

∙ Strategic commercial cooperation would include code sharing, route planning, joint marketing, and alignment of frequent flyer programs.

This investment made Etihad the first foreign airline to benefit from the revised FDI policy, but it also sparked concerns that the deal amounted to “creeping control”, with Etihad acquiring disproportionate influence relative to its equity stake.

Competition Commission of India (CCI) Review

A. Notification and Analysis

The parties notified the combination to the CCI as required. The CCI reviewed: ∙ The nature and extent of Etihad’s control;

∙ The competitive structure of Indian aviation markets;

∙ Horizontal overlaps in international air travel.

The review process involved scrutiny of shareholders’ agreements, commercial cooperation agreements, and side letters indicating the roles and rights of Etihad in decision-making.

B. Approval with Observations (November 2013)

On 12 November 2013, the CCI approved the combination, stating that the transaction was not likely to have an appreciable adverse effect on competition (AAEC). However, it made several critical observations:

∙ Control Issue: Although Etihad was acquiring only 24% equity, its influence extended beyond mere minority investment. Etihad had joint control over key operational and strategic decisions.

∙ Competition in International Routes: The combined network of Jet and Etihad, especially in international routes (such as India–Middle East and India–Europe), raised concerns about route dominance and market access for competitors.

C. Dissenting Opinion by CCI Member Anurag Goel

One of the most significant aspects of the CCI’s review was the dissenting note issued by Member Anurag Goel. He argued:

∙ The deal amounted to joint control, giving Etihad significant strategic influence;

∙ The transaction was likely to cause AAEC, particularly in international air services where Jet and Etihad had overlapping routes;

∙ The deal could result in concerted practices that would be detrimental to competition.

Goel further stressed that the FDI norms were being stretched beyond intent, effectively allowing a foreign airline to influence an Indian carrier’s operations.

Regulatory Backlash and External Review

A. Request for Rectification Denied

Following the CCI order, Jet and Etihad requested deletion of references to “joint control” in the decision, arguing that such a characterization might create regulatory and compliance hurdles with other bodies like SEBI and the Ministry of Civil Aviation. The CCI rejected this request, affirming its stance that Etihad had acquired joint control in effect.

B. Securities and Exchange Board of India (SEBI) Intervention

SEBI examined the implications of Etihad’s control rights, particularly regarding:

∙ Whether the deal triggered the open offer requirement under the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011.

∙ Concerns that minority shareholders might be unfairly prejudiced if control changed hands without a mandatory offer.

After some delay, SEBI eventually approved the share transfer but mandated specific disclosures and safeguards.

C. International Scrutiny

∙ The Competition Commission of Singapore also reviewed the deal, focusing on overlapping routes between India and Singapore.

∙ Other jurisdictions expressed concerns about market dominance, bilateral air service agreements, and slot allocation.

CCI Penalty for Late Filing (December 2014)

In December 2014, the CCI imposed a penalty of ₹1 crore on Jet Airways and Etihad for failing to notify all relevant agreements in a timely and transparent manner. This included side letters and commercial agreements that had a bearing on control and market operations.

Key Legal and Competitive Issues

1. Nature of Control

The deal tested the boundaries of “control” under Indian competition law. Despite holding only 24%, Etihad’s board representation, veto rights, and influence over strategic matters signified shared control—a point that carries implications in merger control regulations and FDI norms.

2. Horizontal and Vertical Integration

∙ The CCI focused on horizontal overlaps in international routes, especially in the Gulf and Europe sectors.

∙ Vertical issues were also analysed concerning ground handling, cargo operations, and airport access.

3. Consumer Welfare

While the parties argued that the deal would improve connectivity, lower fares, and provide better service, dissenting views highlighted reduction in competitive choices and potential fare coordination.

4. Regulatory Coherence

The case highlighted challenges in inter-agency coordination between CCI, SEBI, Ministry of Civil Aviation, and international regulators.

Lessons Learned and Precedent Set

1. Broad Definition of Control: The case confirmed that control under the Competition Act is not limited to majority shareholding but includes material influence and strategic participation.

2. Comprehensive Disclosures: Parties must disclose all relevant documents and arrangements, including side letters and informal understandings.

3. FDI Structuring Needs Caution: The deal illustrated the regulatory tightrope involved in cross-border investments in strategic sectors like aviation, telecom, and defence.

4. Dissent as a Marker of Institutional Independence: The strong dissent by Anurag Goel emphasized that internal checks within regulatory bodies play a critical role in democratic governance and legal evolution.

Case Laws and Authorities Cited

∙ Competition Act, 2002 – Sections 5 and 6 (Combination Regulation)

∙ Jet Airways (India) Ltd. and Etihad Airways PJSC [C-2013/05/122]

∙ SEBI Takeover Regulations, 2011

∙ United Brands Company v. Commission (ECJ, 1978) – Emphasizing effective control ∙ Standard Chartered Bank v. CCI (Delhi HC, 2014) – Jurisdiction in competition cases.

Conclusion

The Jet–Etihad deal was a watershed moment in India’s aviation and competition law landscape. It pushed the boundaries of how regulators interpret “control,” “combination,” and “competition” in transnational transactions. The case underscored the CCI’s evolving role in not just assessing traditional mergers but also scrutinising nuanced strategic partnerships that may mask control or influence.

While the CCI ultimately approved the deal, the strong dissent, the regulatory aftershocks, and foreign jurisdictional reviews revealed the layered complexity of modern M&A activity. The case remains a precedent-setting decision for law students, policy analysts, and corporate strategists.

As India continues to liberalise its economy while safeguarding national interests, the Jet–Etihad case serves as a textbook example of balancing foreign investment with competition law safeguards. It urges transparency, inter-agency synergy, and a deeper understanding of strategic control in cross border deals.

References

1. Competition Commission of India, Order under Section 31(1) of the Competition Act, 2002 in Combination Registration No. C-2013/05/122, Jet Airways (India) Ltd. and Etihad Airways PJSC, dated 12 November 2013.

2. Press Information Bureau, Government of India, Cabinet Approval of FDI in Civil Aviation, September 2012.

https://pib.gov.in/newsite/PrintRelease.aspx?relid=87586

3. Securities and Exchange Board of India (SEBI), Takeover Regulations, 2011 — Regulation 3 and Regulation 4.

https://www.sebi.gov.in/legal/regulations/aug-2011/sebi-substantial-acquisition-of-shares-and takeovers-regulations-2011-last-amended-on-march-6-2017-_20208.html

4. Goel, Anurag, Dissenting Note in CCI Jet-Etihad Order, Combination Case No. C 2013/05/122, 2013.

[Referenced from CCI archives and public filings]

5. Competition Commission of India, Press Release on Penalty for Non-Disclosure of Material Facts – Jet-Etihad Deal, December 2014.

https://www.cci.gov.in/sites/default/files/press_release/press240_0.pdf

6. Bhargava, Jitendra v. CCI, Competition Appellate Tribunal (COMPAT), Appeal No. 10 of 2013, Dismissed March 2014.

[Legal databases such as Manupatra / SCC Online]

7. Ministry of Civil Aviation, FDI Policy in Civil Aviation, Consolidated FDI Policy, Circular No. 1 (2012).

https://dpiit.gov.in/policies-rules-and-acts/foreign-direct-investment-policy

8. United Brands Company v. Commission of the European Communities, Case 27/76, [1978] ECR 207, European Court of Justice – concept of effective control.

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A61976CJ0027

9. Standard Chartered Bank v. CCI, Delhi High Court, WP(C) No. 3418/2014, Judgment dated 12 September 2014 — discussing jurisdiction of CCI in merger matters.

[Available on Indian Kanoon / SCC Online]

10. Business Standard. “CCI clears Jet-Etihad deal, says no adverse impact on competition”, 12 November 2013.

https://www.business-standard.com/article/companies/cci-clears-jet-etihad-deal 113111101130_1.html

11. Live Mint. “CCI imposes Rs 1 crore fine on Jet, Etihad for incomplete disclosures”, 4 December 2014.

https://www.livemint.com/Companies/lEdIIBUwP1uszn96bMc4hN/CCI-fines-Jet-Etihad-Rs 1-crore-for-not-disclosing-full-deta.html

12. The Hindu. “Jet-Etihad deal: CCI terms it joint control”, 26 November 2013. https://www.thehindu.com/business/Industry/jetetihad-deal-cci-terms-it-joint control/article5393299.ece 13. Singh, D.P., Competition Law in India: Policy, Issues, and Developments, LexisNexis, 2018.