Author- Yogita

Abstract

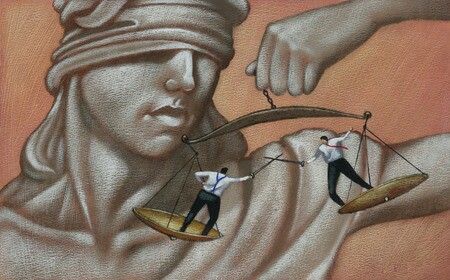

Addressing corporate fraud: The Indian legal system, especially Companies Act, 2013, and Insolvency and bankruptcy code (IBC), 2016 to battling corporate fraud. Section 447 of the Companies Act defines the crime of fraud broadly and provides harsh penalties, such as up to ten years of imprisonment and fines, up to three times the amounts of the fraud, and higher in the case of frauds of public interest. Section 212 gives civil powers to the Serious Fraud Investigation Office (SFIO), which engages in cross-disciplinary inquiry into complicated frauds, frequently with the assistance of forensic audits. The IBC also has the allowance of recovery of assets under trade or wrongfulness (Section 66) and the applicability of circumstances to pierce the veil where the value of assets undervalued is recycled or transferred as a favour to a related party prior to insolvency (Sections 43, 45, 49, 50) through avoidance transactions to remedy a wrongful action. In both legal systems, forensic audits play a very important role. They are expert investigations and are undertaken to reveal, measure, and accumulate discernible proof of fraud, recognize prohibited dealings, and isolate them to those responsible.

Introduction

Corporate frauds are also a great menace to the consolidation of the financial system where investor confidence is injured, economic losses are borne, and some companies that were held high become collapsed. In India, the legal system, the Companies Act, 2013 and the Insolvency and Bankruptcy Code (IBC) 2016 have been enhanced mainly with the help of the important role played by a forensic audit in fighting this menace. The paper will explore the major legal provisions with examples of illustrative case laws, as well as to point at the importance of home-town audits in discovery and prosecution of corporate fraudulence.

What is Corporate Fraud?

Corporate fraud is a broad term and this represents illegal acts committed within a company or against a company in an effort to steal, take unfair benefit or injure the company or its stockholders, creditors, or other parties with an interest. It may occur in many ways, among them being:

Financial Statement Fraud: Alteration of financial records to show a false impression of the company financial health (aka, Revenue and expense manipulation to understated or overstated, creation of false assets).

Asset Misappropriation: Inventing, stealing or using company assets (i.e. embezzling, siphoning, recreation of company assets). Corruption False expenses and kickbacks as well as subsequent bribes to achieve business benefits that are unfair.

Insider Trading: The Practice of trading in securities, with the information of material nonpublic information.

Under the Companies Act 2013: Legal Provisions

The Companies law, 2013, has greatly strengthened the legal system of handling corporate fraud which is accompanied by very strict comings and penalties to discourage corporate fraud.

1.Section: 447 (Punishment of Fraud): It lays down the definition of the term fraud to be inclusive of any act, failure, covering up of any fact, or. misuse of position of any one, with intent to deceive, unfair enrichment contrary to, or detrimental to the interests of the company, its shareholders, creditors, or that of any other person, the question of whether there was a wrongful gain or wrongful loss or not.

Defining aspects of Section 447:

- Definition of Fraud: The commentary to Section 447 has described a definition of Fraud comprehensively, capturing deceitful conducts of different forms. There is more than a so-called wrongful gain to the wrongdoer or wrongful loss to the victim; an intention to defraud or hearse is all that is required.

- Punishment: The offenses in Section 447 are harsh, and they differ depending on the extent of fraud that is involved and whether it involves the interest of the society.

2. Section 212: Investigation of serious fraud Investigation Office (SFIO) Companies Act, 2013, gives the Central Government the powers to refer cases of a corporate. put forward fraud to be checked by Serious Fraud Investigation Office (SFIO).SFIO is a Interdisciplinary organization composed of professionals of different fields such as financial Accounting law, specifically constituted with the aim of investigating difficult corporate claims to forensic auditing and banking frauds.

- General emphasis of Section 212: Investigation Authority: The Central Government has the power to instruct an investigation by the SFIO when it thinks that there is need to probe into the activities of a company because of suspicions of frauds, misfeasance or misconduct.

- Powers of SFIO: SFIO has wide powers of investigation that entail searching on warrant, execution of search warrants, taking of documents, placing witnesses in the witness stand and arrests. is suspected to have committed fraud.

An example is Case Law:

The Satyam Computer Services Scandal (before the 2013 Act but a good representation of why such a thing is needed). the need of a special body to investigate (as was pointed out in the case of an agency such as SFIO) was noted. big industries frauds. As much as the inquiry process was undertaken by different organizations, the legislative purpose in setting up the SFIO was to simplify and specialize such investigations. In other instances, the SFIO has assumed the cases of investigation of many Purported frauds, in which forensic audits are very important in proving the truth.

3. Some other applicable sections in the Companies Act, 2013:

- Section 337 (Penalty as regards frauds by officers): Concerns those officers of a company which: if by any false pretence they had procured credit, or defrauded creditors, they were thereupon wound up.

- Section 448 (Punishment of false statement): Puts a person liable to a penalty or punishment who states a false statement. statement of any return, report, certificate, financial statement, prospectus, or other document.

- The section 449 (Punishment for false evidence): Covers the giving of the false evidence.

- Section 224 (Report by inspector): A report by an inspector who is appointed to report on a company: affairs are able to present a report which may be used in a legal case. This report Frequently it involves results of forensic tests.

- Section 241-242 (Oppression and Mismanagement): Although this statute has nothing to do with fraud per se, it is in these parts that the National Company Law Tribunal (NCLT) can interfere in matters of repression of minority shareholders or malmanagement which usually are rooted in aspects of fraudulent behaviour.

Provisions according to the Insolvency and Bankruptcy Code, 2016 (IBC)

IBC 2016 has brought about a paradigm shift in the insolvency regime of India, and the center of attention is on the insolvency of a business entity. restructure as opposed to wind down.The role of forensic audits is even higher. such a transaction under IBC plays one of the most significant roles in reversing such transactions.

1. Section, 66: Fraudulent Trading or Wrongful Trading Section 66 of IBC is a strong mechanism to resolve the issues when business of the Corporate Debtor (CD) has been continued under the intention of cheating creditors or in any other way. fraudulent purpose. Important points of Section 66:

- Scope: is in effect when in the course of the CIRP or liquidation.

- Liability of Directors/Partners: In case it is discovered that any of the businesses of the CD has been conducted, then a liability shall incur on the part of their Directors/Partners made otherwise with intentions defrauding creditors, or on any fraudulent purpose the Adjudicating Authority At the request of the person administering the resolution (RP) or liquidator, (NCLT) can direct any order regarding the following: Individuals who, deliberately, were parties to the conducting of the business in that way to contribute to such assets of the CD as it may see good to contribute.

- Wrongful Trading: There is also the section 66 on wrongful trading, directors or partners whose named partner shall consist of: cont. to carry on the business at the time when they knew or should have known that there was not a fair prospect of escape out of insolvency. In this situation, they can be liable. individually liable to make contributions to the assets of the CD.

- Requirement of Knowingly Parties: The provision demands that persons be either of a knowingly party. The participants who are involved in the fraudulent or wrongful trading are now known as to the parties so as to be “knowingly parties” to the fraud or the wrong. This has many times required a forensic analysis of procedures to determine motive and participation.

2. Avoidance Transactions (Section 43, 45, 50) The IBC enables the RP or liquidator to undo some of the transactions which have been entered into by the Below is not subject to the provisions of section 393(2) of the Companies Act (2001) in so far as related to any personal guarantee not one provided by or on behalf of the corporate debtor before the insolvency commencement date, in case such transactions were is aimed at cheating creditors or giving preferences to some parties. These are in general terms labeled as avoidance transactions and they are the area that forensic audits are most likely to find.

Section 43: Preferential Transactions: A transaction can be given a character of preferential where they pay a creditor at a time when other creditors remain unpaid. assured or surety, or guarantor, in better circumstances than it would have been had not been the case. allocation of assets in liquidation, and such sale is realized at a time of the so-called relevant period (one year where parties are unconnected and two years where parties are related). value which is much less than the consideration given by the CD entered into the, “relevant period. ”

Example of the Case Law: Anuj Jain Creditors Interim Resolution Professional Jaypee, comes to a conclusion The Supreme Court rightfully gave its ruling with regard to Anuj Jain, the Creditors Interim Resolution Professional Jaypee. The case of Infratech Ltd. v. Axis Bank Ltd. & Ors. shed a lot of light on the scope of the definition. construction of the preferential transaction provided in Section 43 of the IBC. Although not a strict one, during the case of fraud it is essential to note that there will be levels of consideration of previous deals on the idea of fairness. the part of the RP (who, incidentally, are also forensic auditors) in detecting such transactions.

3. Section 65: Wiles and Wicked Applications into Proceedings This part serves as a discouragement to abuse insolvency process. It entails fine in case one person fraudulently or with malafides approaches the insolvency resolution used in any process or liquidation proceedings with any purpose but the purpose of insolvency resolution or liquidation.

Forensic Audit: The Necessary Function Forensic audit involves targeted audits on financial books to establish facts of crime. fraud, misconduct or any fiscal abnormality. They are more than a conventional audit. Its main duty lies in the verification of financial statements and their accuracy and compliance. In the in a context of corporate frauds and insolvency, forensic audits play the key roles in:

Identification and Finding: Forensic auditors use specific methods of spotting red trace illegal transactions, investigate intricate financial data, and re-enact them using flags. get to know the mode of operation of the scam. This includes:

- Data analytics in order to find anomalies and patterns.

- Assessment of the internal controls to establish weaknesses.

- Following fund flow to have diversion of funds.

- Testing emails, contracts, and other papers in terms of inconsistencies.

- Questioning of crucial employees and whistleblowers.

Measurement of loss: Another significant goal of forensic audit is to measure the loss in finance. impact of the fraud, which is one of the main aspects of ascertaining the level of damages, and legal proceedings.

Evidence Taking: Forensic auditors have practise in dealing with evidence in a way that is A fact that could be accepted in a court of law. The legal teams and regulators tend to rely on their reports. and tribunals.

Dealing with Perpetrators: Financially, through careful examination of financial and other factors, even the perpetrators can be found out. forensic audits are useful in establishing the perpetrators of the crime they are used to uncover evidence. fraudulent activities.

Advice on Legal Cases: Forensic auditors may provide support in legal disputes by esteem witness. in explaining complicated financial terms and the result of their inquiry in a clear manner in a court. and in a succinct way.

Asset Tracing and Recovery: In cases of insolvencies, the forensic audits play a significant role in tracing resources which may have been sold out or siphoned out due to fraudulent activities and allowed the RP or to liquidator so that he can issue avoidance measures to recover them.

Forensic Audit in Companies Act:

The investigation of the case under the Companies Act commences when taken up by the SFIO or any other investigating agencies. They always depend on the experiences of the forensic accounting and auditing. The forensic auditors role is to collect information. report contains the technical support of allegations based on Section 447 or some other relevant entities, the description of how a fraud was perpetrated, who it involved, and how much money was affected by it.

IBC situation Forensic Audit: The RP or liquidator is duty bound, by statute, to make enquiries into the affair of the company, under the IBC. Corporate Debtor together with former transactions. This commonly requires the selection of a forensic auditor.

The outcome of the forensic audit are applicable in: Finding Preferential and undervalued dealings:

The forensic auditor studies: identify such by use of past financial records, bank statements and documentation of transactions transactions, parties involved and involved.

Establishing Fraudulent/ wrongful Trading: Forensic auditor would aid in establishing how the business was conducted either with fraud or wrongful purposes by analysing the financial position of the company before it falls into insolvency and analysing the decisions taken by the management. Identifying Diversion of Funds This is where forensic audit is most essential in terms of establishing to where diverted funds have been diverted with particular respect to connected individuals so that the RP can sue accordingly.

IBC Case Law of Forensic Audit:

The NCLT and NCLAT have continually insisted on the concept of forensic audit during insolvency processes. To cite an example, in TJSB Sahakari Bank Ltd. Vs. Ms. Jovita Reema Mathias and Ors. the NCLT Mumbai Bench held that the act of IBC today, grants the Resolution Professional, a power to appoint professionals to conduct Forensic/Transaction Audit of the Corporate Debtor and this power does not require any specific approval of the CoC. Latest Cases of Corporate Frauds (Examples) Though individual cases of large judgments during or after the provisions of the Companies Act 2013 and IBC keep changing all the time, one such case on how study of corporate fraud in India is an evolving concept is:

Debock Industries Ltd. (July 2025): Debock industries limited was recently detected to have committed a financial fraud of over INR 100 crores by the enforcement directorate (ED). It claims that the firm made up false companies and employed fictional directors in order to enhance profits and balance sheets resulting in the sudden astronomical rise in stock price.

Such examples illustrate the importance of effective legal frameworks and special investigative mechanisms such as forensic audit when combating the constantly changing world of corporate fraud.

Conclusion

Given the Companies Act, 2013, and insolvency and bankruptcy code, 2016, India now has a much stronger legal armory against corporate fraud. Section 447 of the Companies Act has a very broad formulation in terms of definition of fraudulent conduct and severe penalties and SFIO is an exclusive agency devoted to the investigation. Forensic audits play a major role in ensuring successful application of these laws. These expert examinations are what gives critical evidence, examination and expertise necessary to disclose, measure, and eventually bring to justice corporate fraudsters.

Reference