Indemnity clauses play a pivotal role in contracts by allocating risks and liabilities among parties. Today we will explore the fundamental principles of indemnity clauses, their significance in various contractual contexts, and the challenges they present in balancing risk and reward. Through legal analysis, and insights into drafting techniques, this write up aims to provide a comprehensive understanding of indemnity clauses to help parties achieve equitable and effective agreements.

What are INDEMNITY CLAUSES?

Indemnity clauses are contractual provisions that obligate one party to compensate the other for certain losses or liabilities. Widely used in commercial agreements, these clauses ensure risk allocation and provide financial protection

Types of Indemnity

- 1.Broad Form Indemnity: Covers all losses arising out of specified events, regardless of the indemnified party’s fault.

- 2.Intermediate Form Indemnity: Covers losses caused partially by the indemnified party’s fault but excludes losses arising solely from their gross negligence or willful misconduct.

- 3.Limited Form Indemnity: Restricts coverage to losses directly caused by the indemnifying party.

Legal Principles:

Key legal principles affecting indemnity clauses include:

- 1.Freedom of Contract: Parties have the autonomy to define the scope and terms of indemnity.

- 2.Interpretation: Courts often construe indemnity clauses narrowly, especially if the language is ambiguous.

- 3.Public Policy: Certain jurisdictions limit indemnity for liabilities arising from intentional misconduct or gross negligence.

Join LeDroit India WhatsApp Group to stay updated-CLICK HERE

Drafting Indemnity Clauses:

Effective drafting of indemnity clauses requires precision and clarity. Ambiguities can lead to disputes and unintended liabilities.

Sample Indemnity Clause – Employment Agreement

Indemnification: The Company shall indemnify and hold Employee harmless to the fullest extent permitted by the laws of the Company’s state of incorporation in effect at the time against and in respect of any and all actions, suits, proceedings, claims, demands, judgments, costs, expenses (including advancement of reasonable attorney’s fees), losses, and damages resulting from Employee’s good faith performance of Employee’s duties and obligations with the Company. Executive will be entitled to be covered, both during and, while potential liability exists, by any insurance policies the Company may elect to maintain generally for the benefit of officers and directors of the Company against all costs, charges and expenses incurred in connection with any action, suit or proceeding to which Employee may be made a party by reason of being an officer or director of the Company, or any subsidiary or affiliate, in the same amount and to the same extent as the Company covers its other officers and directors. These obligations shall survive the termination of Executive’s employment with the Company.

Reference:

Security Exchange Commission – Edgar Database, EX-10.281 4 d226725dex10281.htm EMPLOYMENT AGREEMENT, Viewed March 31, 2021, < https://www.sec.gov/Archives/edgar/data/1003124/000119312511292827/d226725dex10281.htm >.

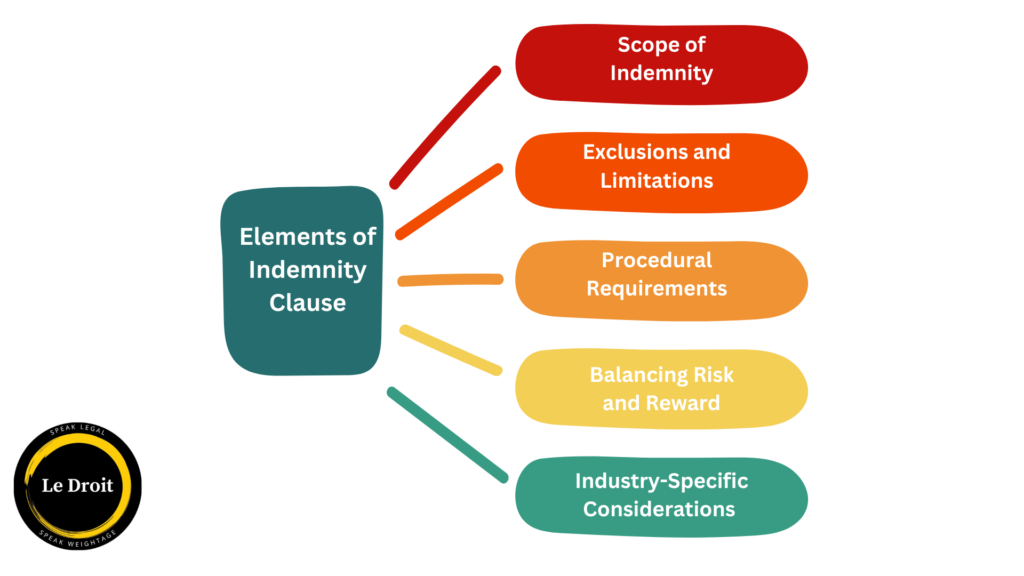

The following elements are crucial in drafting:

3.1. Scope of Indemnity

Clearly define the events or circumstances triggering indemnity. Examples include:

- Third-party claims

- Breaches of contract

- Regulatory fines or penalties

3.2. Exclusions and Limitations

Specify exclusions to indemnity, such as:

- Losses caused by gross negligence or willful misconduct

- Consequential or indirect damages

- Cap on indemnity liability

3.3. Procedural Requirements

Include procedures for invoking indemnity, such as notice requirements, defense and settlement control, and cooperation obligations.

4. Balancing Risk and Reward

Indemnity clauses should balance the interests of both parties by:

- Allocating Risks Fairly: Avoid shifting disproportionate risks to one party.

- Enhancing Negotiation: Clearly articulate the mutual benefits and liabilities.

- Ensuring Financial Viability: Assess the indemnitor’s capacity to fulfill obligations.

4.1. Industry-Specific Considerations

Indemnity clauses vary across industries. For instance:

- Construction Contracts: Address risks related to property damage, personal injury, and environmental liabilities.

- Technology Agreements: Focus on intellectual property infringement and data breaches.

- Energy Contracts: Emphasize indemnity for environmental incidents and operational risks.

5. Legal Framework in India

Section 124 of the Indian Contract Act, 1872 (“Act”), defines the principle of indemnity. It characterizes indemnity as a contractual agreement where one party commits to compensating the other for losses incurred due to the actions of the promisor or another party. According to the Act, a contract of indemnity is “a contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person.” The Himachal Pradesh High Court, in the case of HP Financial Corporation v. Pawana & Ors (1997), and later the Supreme Court in Deepak Bhandari v. Himachal Pradesh State Industrial Development Corporation Limited (2010), affirmed that a contract of indemnity operates independently of the primary agreement. Additionally, subject to state laws, the stamp duty payable on indemnity clauses is distinct and supplementary to that of general agreements.

Section 125 of the Act grants indemnity holders specific rights, obligating the indemnifier to reimburse damages, cover legal costs, and compensate for sums paid as part of a settlement. However, the Act’s definition of indemnity is limited to losses arising from the actions of the indemnifier or a third party. This narrow scope excludes broader obligations, such as implied indemnity or the right to sue before actual damage occurs, which remain underdeveloped in Indian jurisprudence. Consequently, carefully structured indemnity clauses are vital in commercial agreements to allocate risks and ensure fairness.

Sample Indemnity Agreement-CLICK HERE

Challenges in Enforcement

- Ambiguity: Poorly drafted clauses lead to disputes over interpretation.

- Jurisdictional Variations: Different legal systems impose varying limitations.

- Financial Insolvency: The indemnitor’s inability to fulfill obligations undermines the clause’s purpose.

Conclusion and Recommendations

Indemnity clauses are indispensable tools for managing contractual risks. However, their effectiveness depends on careful drafting, a thorough understanding of legal principles, and practical negotiation strategies. Parties should:

- Use clear and specific language.

- Align indemnity provisions with applicable laws and public policies.

- Conduct risk assessments to ensure equitable allocation.

- Regularly review and update clauses to reflect changing circumstances.

By striking a balance between risk and reward, indemnity clauses can foster trust and cooperation in contractual relationships.