This Article is written by Gowra Manogna, mahatma Gandhi law college, B.B.A LL.B. (4th year) during her internship at LeDroit India.

Abstract

Satyam Computer Service limited was founded in 1987 by Ramalinga Raju. The core services are software development, engineering design, software integration into systems, ERP solutions, consultation, IT outsourcing, and system maintenance.

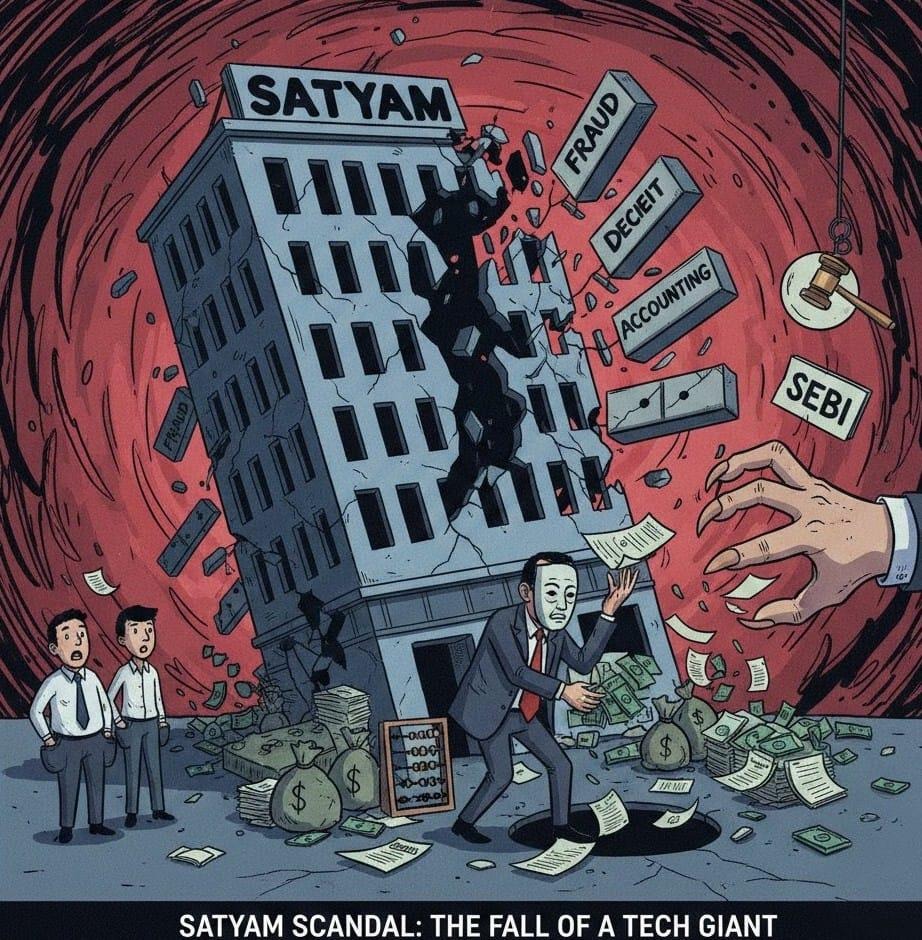

The case unfolded in 2009 when the chairman, Ramalinga Raju, publicly confessed stating that manipulating financial statements, inflating profits, fabricating assets, and falsifying invoices resulted in 7,800 crores in accounting fraud. The legal dispute centred on charges of breach of trust, fraudulent, violations of the Companies Act and SEBI regulations. In 2015, by the CBI special court order, Raju and key executives are sentenced to rigorous imprisonment. This scandal highlights the importance of securities laws and corporate governance. It became the turning point in India’s corporate regulatory landscape.

Key words

Corporate accounting fraud, case study, Satyam scam case, Satyam computers, Ramalinga Raju, top scam cases in India, corporate governance, Accounting and Auditing Standards.

Content

- Introduction

- Legal framework

- Satyam Computer Service Limited case study

- Facts of the case

- Issues

- Arguments

- Judgement

- Conclusion

- References

Introduction:

Have you ever come across a fraud case where the wrongdoer himself unveiled the truth? The most infamous example is the Satyam scam, which shook the entire nation. The irony is the name Satyam, which translates to “truth” in Sanskrit, became synonymous with one of India’s most shocking betrayals of trust.

When the scandal erupted in 2009, it didn’t just expose manipulation of accounts; it forced India to confront deep flaws in its corporate governance framework. The fallout reshaped regulatory norms and scrutiny on board practices and marked a turning point in the country’s governance.

Satyam computer’s limited company was once one of the fastest-growing companies in India. In fact, Indian media referred to it as “India’s Enron.” At its peak, the company received several prestigious recognitions, including the “Golden Peacock Award” for best-governed company in 2007 and again in 2009. Its reputation extended far beyond India; it was considered as one of the leading IT companies across Asia. However, everything came crashing down in 2009.

In the investigation, authorities found that balance sheets, invoices, and financial statements are manipulated, showcasing that almost 7,800 crores of assets are generated in records whereas they don’t exist in real life.

Legal framework

- Indian penal code (IPC), 1860: company is charged under various sections of IPC

Section 120B: criminal conspiracy.

Section 405: criminal breach of trust.

Section 409: criminal breach of trust by public, servant, or by banker, merchant or agent.

Section 415: cheating.

Section 417: punishment for cheating

Section 420: cheating and dishonestly inducing delivery of property.

Section 463: forgery

Section 468: forgery for the purpose of cheating.

Section 471: using as genuine a forged document or electronic record.

Section 477A: falsification of accounts. (Indian penal code)

- SEBI Act, 1992: it has started its own investigation imposing penalties for violating securities laws. This led to a ban on accused and accused family for a period of 14 years. Furthermore, SEBI has strengthened its regulatory framework on corporate governance, accountability on auditor, and independent directors. It was held liable under sections 12 (a), (b), (d), and (e) of SEBI act; regulations 4(2)(a), (e), (f), (k) and (r) of the SEBI (prohibition of fraudulent and unfair trade practices) regulations,2003; and regulations 3 and 4 of the SEBI (prohibition of insider trading) regulations, 1992.

- The Companies act ,2013: in response to the Satyam scam case, section 447 specifically address the fraud. With the minimum punishment of 6 months to 10 years of imprisonment and fine of 3 times the amount of fraud.

Facts of the case

It all started, when CEO and chairman of the board of directors, Ramalinga Raju, wanted to acquire two companies, Maytas Infrastructure limited and Maytas properties limited. It was proposed to buyout at value of $1.6 billion and supposed to be used from the company’s available capital and cash.

This decision was solely taken by the BOD without approaching the shareholders and investors for the opinion. It was announced to public on 15 Dec 2008, for the purchase of two companies even when members opposed it. Later it was withdrawn.

On 7th Jan 2009, CEO and Chairman Ramalinga Raju submitted his resignation along with confession letter which explains about the fraud he committed over years and apology to bank. In the letter it was mentioned that he manipulated over the financial records and accounts to create around Rs. 7,800 crores of assets which doesn’t exist.

It has explained in the letter that he planned to convert the fabricated money into real money by buying out the two Maytas companies that were owned by his family. By this he thought he can fill the gap between the balance sheet value to real value, he did this to attract new investors and shareholders. However, with each year the value just increased which made it impossible to attain. “It was riding a tiger and not knowing how to get off without getting devoured”

Investigation was conducted based on letter, and it was conformed everything to be true by the Indian government. It was said the companies he thought of buying were the companies of his sons and he planned to cover the false assets as the money spent to buy purchase the company.

Ramalinga Raju, Raju’s brothers, Rama Raju, were arrested by the Andhra Pradesh police and charged under the Indian penal code, 1860 with the forgery cheating, criminal conspiracy and criminal breach of trust, section 463, 417, 120B, 405.

Central government took over the company by arresting the directors who resigned and appointed new directors for the damage control. Rest of the management were all under the investigation which made company situation quite worst.

To prevent the company from going under and winding up, new members are introduced including, HDFC chairman Deepak S. Parekh; C. Achuthan, who was a former member of SEBI and director of NSE (national stock exchange) and Kiran Karnik, who was an IT specialist and former president of NASSCOM. Tarun das, the ex-president of the Institute for Chartered Accountants (ICAI) and S. Balakrishnan, who was a former member of LIC.

Auditors were also under investigation for the possible involvement in the scam. Since, PwC has worked with Satyam for years they were under investigation, they have claimed that they weren’t able to detect any of the fraudulent activities, PwC denied the suspicion. It was said that PwC made the reports based on the financial statements provided to them by Satyam. They have admitted that it was their negligence and carelessness resulted to scam.

Senior partners and auditors of PwC, S. Gopalakrishnan and Srinivas Talluri were arrested by CBI branch of Andhra police charged for fraud under section 420 of IPC and criminal conspiracy section 120B of IPC.

The investigation has uncovered the fraud committed by the CEO of Satyam’s company, Srinivas Vdlamani who apparently created fake accounts of about 10,000 employees to generate Rs.20 crore as salary each month. Those salaries straight went to his account. Later during the raid at houses of Raju his younger brother Suryanarayana Raju, 112 sale deeds were found that were of different lands properties under the name of various family members and relatives of Raju.

Issues of the case

- Did Raju and other are held liable for the offences under Indian penal code IPC, such as criminal conspiracy, forgery, breach of trust, cheating?

- External auditors PwC (Price Waterhouse) were also complicit to a degree warranting criminal liability?

- Why did board of directors failed to detect the fraud?

- what powers did SEBI have to pass on institutional order which are typically reserved for the institute of chartered accountants of India (ICAI) forcing judicial system to define the precise jurisdictional boundaries between market oversights (SEBI) and professional discipline (ICAI).

- What kind of reforms are necessary in the aftermath to prevent the reoccurrence of these kinds of frauds?

Arguments

Arguments from prosecution:

- It was argued that this is a systematic fraud which is planned for the long run not just a one-time accounting fix. Raju himself admitted to manipulating accounts over many years, inflating cash, faking invoices.

- Evidence showed that top management, financial staff, and even external auditors actively participated and aware of fraudulent activities.

- Raju and the connected people have made illegal gains by manipulating the records making the market inflated financials misleading the investors, artificially boosting share price

- SEBI pointed that PwC auditors’ failure to follow the regulations and neglected their duty, SEBI argued that “failure to seek external confirmation of the bank balances, fixed deposits, failure to detect fake invoices without adopting the rigorous procedure mandates by auditing and assurance standards draws an inference of gross negligence and inference of involvement in the fudging of the accounts”. Sebi said, “this gross negligence amounts to an act of commission of a fraud for the purposes of the Sebi act.” (times of India)

Arguments from respondent:

- G. Ramakrishna claimed that they followed the instruction and did not fully understand the fraud. In his defence he asserted that manipulation was done by Ramalinga Raju and he was not aware of it.

- They have argued that 14 years of restrain imposed by SEBI had not adequately explained why such a long prohibition was appropriate.

Judgement

Total 10 were accused and all were found guilty under section 120B and section 420 of IPC, let’s assume the accused as A1 – A10. A1 and A2 were found guilty under section 409 of IPC; A3, A4, A7 were found guilty under section 406 of IPC; A4, A5, and A7 were found guilty under section 419 of IPC; A1 to A5 and A6 to A9 were found guilty under section 467, section 468 of IPC, section 417 and 477A of IPC.

Accused were charged with seven years rigorous imprisonment with fine of rs.5.24 crore (approx.) each to Ramalinga Raju them chairman, and then MD both of Satyam computer services ltd and seven years imprisonment with fine ranging from Rs.26 lakhs to Rs. 31 lakhs (approx.) each to eight others in one of the biggest corporate frauds.

Accused members are: – Ramalinga Raju, Rama Raju, Vadlamani Srinivas, Subramani Gopalakrishnan, Talluri Srinivas, Byrraju Suryanarayana Raju, G. Ramakrishna, D. Venkapathi Raju, Ch. Srisailam and V. Suryanarayana Prabhakar Gupta.

The accused were found guilty for bogus inflation of company’s revenue, falsifying company accounts, income tax falsification and invoices of transactions fabrication.

Ramalinga Raju and nine others, two family members were sentenced to seven years rigorous imprisonment. Later convicted individuals with Rama Raju were out on bail by a special court in Hyderabad.

Enforcement directorate files a criminal complaint against 47 persons and 166 corporate entities headed by Ramalinga Raju.

PwC was prohibited by SEBI from auditing listed Indian companies for 2 years, as the regulatory discovered that the auditing company had defaulted in its professional responsibility by signing off a doctored financial account.

Conclusion

Analysis of the case

Opinion on the judgement

- Judgement gave a strong point against corporate fraud. It made clear that prominent business leaders were not immune from law.

- Price Waterhouse cooper, a global leader in auditing companies, were discovered to breach in its responsibility are held accountable. Later, creating a strict auditing and corporate governance regulations.

- SEBI took measures to correct the actions including imposing the ban of PwC for 2 years. Government intervened to prevent more damage by enabling acquisition of Satyam by Tech Mahindra so it will not be affected in the long run.

- This trail took six years to conclude and ongoing appeals have delayed in ultimate conclusion. For which it was criticized for delayed justice.

- 7 years imprisonment for 7,800 feels way too soft. Considering the losses of investors, banks, and employees, it is argued by some that severer punishment such as lifetime exclusion from corporate job or extended terms of imprisonment would be better.

- This judgement highlighted the regulatory failure, noting that SEBI and other corporate regulators oversight bodies failed to detect the ongoing fraud.

Impacts of the case

This scandal highlighted the flaws of corporate practices in India. This emphasis the need of stricter regulations and enforcement to prevent similar frauds. In the aftermath of the scandal, Indian government implemented a series of measures aimed to strengthening corporate governance. Including:

- Introduction of companies act, 2013. Mandated the following:

- The appointment of independent directors,

- The separation of the roles of chairman and CEO, and

- The establishment of audit committees and whistleblower mechanisms in companies.

- Establishing SEBI (securities and exchange board of India) as regulator for listed companies. Which introduced several measures for transparency and accountability. Below are the measures:

- Mandatory disclosures,

- Stricter regulations for auditors,

- Strict enforcement of corporate norms, and

- Increased penalties for non-compliance.

These reforms have helped in improving the overall corporate governance in India.

Need of the hour

- Investigating all the inaccuracies, even the small inaccuracies should be investigated no matter how small it is, as initially every fraud starts out small and turns into large scale misconduct.

- Fast restitution mechanism, establishing faster restitution mechanism to ensure that affected retail investors receive timely compensation once disgorgement is achieved.

- Corporate governance needs to be strong so that this ensures that they won’t be raise of new Satyam cases.

- This case emphasized the need for quicker judicial proceedings in case of financial fraud. This trail lasted more than six years, and appeals are ongoing which delayed justice in white collar crimes enabling perpetrators to play games with legal system, avoiding the punishments and keep enjoying the ill-gotten gains. So quicker judicial proceeding are needed.