This article is written by Gowra Manogna, Mahatma Gandhi Law College, B.B.A. LL.B. (4th Year) during her internship at LeDroit India.

Scope of article

- Abstract

- Introduction

- What is corporate restructuring?

- Types of corporate restructuring

- Demergers

- Amalgamations

- Schemes of arrangement

- legal framework and Amendments

- Conclusion

- References

Key words

Corporate restructuring, mergers, demergers, amalgamations, schemes of arrangement, types of corporate restructuring, restructuring, company, amendmends.

Abstract

Every organization seeks efficiency, stability in its dynamic business environment. The process of corporate restructuring helps in achieving those. This article explores the mechanism of corporate restructuring, mainly focusing on three major restructuring mechanisms i.e. demergers, amalgamations, and schemes of arrangement, and examines their legal frameworks, procedural requirements, and practical implications. It highlights key advantages, challenges, regulatory compliance.

Introduction

Business organizations classically expand in two main ways: organic and inorganic growth. Company can organically grow through the internal sources such as operational or financial restructuring aimed at boosting company base, improving sales, and increasing revenue, and all without change in the corporate entity.

On the other hand, Inorganic growth, allows a company to accelerate expansion by acquiring new business. It’s often achieved through mergers, amalgamations, and similar restructuring methods, which are among the most significant routes to this type of growth.

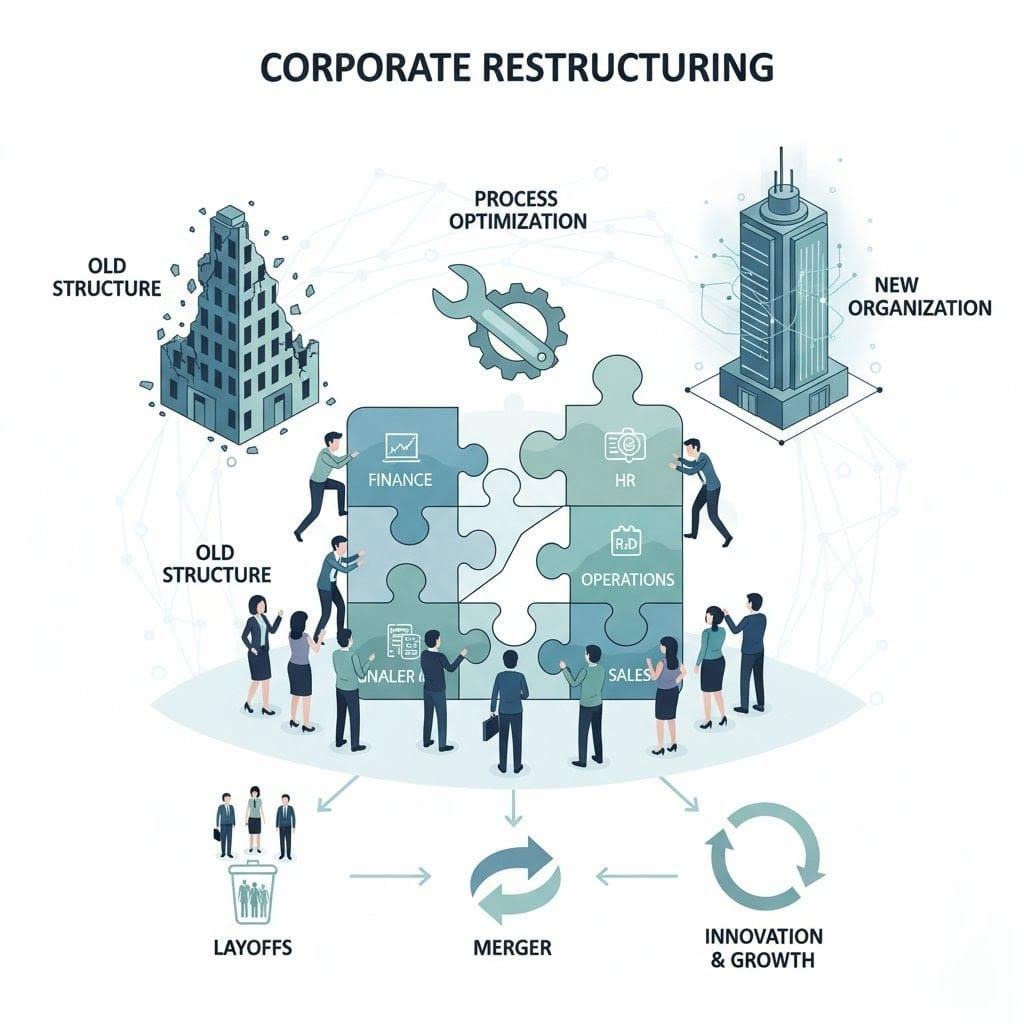

Corporate restructuring refers to the phases a company takes to reorganize its internal structure or operations. It involves reorganizing the business to improve efficiency and boost profitability. It requires significate changes within the company, such as eliminating or combining departments. In other words, it is a comprehensive process through which a company streamlines its operations and enhance its overall strength, enabling it to achieve strategic goals, gain synergies, and remain competitive and successful in the market. Corporate restructuring is the process that significantly changing a company’s business model, management team or financial structure to address challenges and increase shareholder value. Corporate restructuring is an inorganic growth strategy.

What is corporate restructuring?

To achieve certain goals such as becoming more competitive in market or responding to the changes, company undergo the process called corporate restructuring. This involves redesigning a company’s organizational hierarchy, internal framework, or operational methods. To enhance the company’s performance and eliminate financial crisis, corporate restructuring takes place. When there is a change in ownership structure of company by takeover, bankruptcy, adverse changes, economic conditions, buyouts, over employed, etc. then the need for corporate restructuring arises. Corporate restructuring is undertaken by companies to achieve few objectives at corporate level such as orderly redirection of the firm’s activities, reduction of risk, developing core competencies, for the profitable growth.

Types of restructuring

There are 3 major types

Financial restructuring: this focuses on financial aspects. When company is facing crisis in sales and overall economic conditions this restructuring takes place. Some methods are

- Debt restructuring: – company will lower its debt burden by paying off existing debt, or negotiating for better interest rate in favour to company. Converting debt into equity.

- Equity financing: – new equity is issued by the company to raise its capital, by the buyback of shares, issuing shares to shareholders.

Organizational restructuring: in this restructuring the company’s internal hierarchy is changed. Such as, merging and eliminating some roles. Changing the working relations as creating new jobs, departments, while eliminating others. All of these is done for the improvement of productivity, efficiency and better communication.

Corporate restructuring: this is the broader term that involves both financial restructuring and organizational restructuring. It involves change in strategy as removing subsidiaries that does not align with company vision. Giving its prominence to core strategy. Managing the assets or business combinations to strengthen the company’s position.

Types of Corporate Restructuring Strategies

- Merger: where two or more companies combined either through amalgamation or absorption. Where the shareholder of the companies are typically offered securities of the acquiring company in exchange for surrendering their existing shares. Companies are merged through horizontal merger, vertical merger, co generic merger, conglomerate merger.

- Demergers: it is also identified as spin-off or divestiture, when the units or assets of company’s business are separated into independent entities by splitting them is a corporate restructuring strategy. It was undertaken by companies to promote specialization. This allows the specific unit or assets to grow as separate and a focused entity, increasing its efficiency and effectiveness. This enables large companies to detach specific brands or divisions to attract or avoid takeovers, generate capital by selling non-core segments, or establish distinct legal entities for different business activities.

Types of demergers

- Spin-off: it occurs when parent company separates a part of its operations to form a new, independent company. The shares of newly created entity of the company are distributed to parent company’s existing shareholders. This enables the spun-off business to function autonomously and focus on its own strategic goals.

- Crave-out: a crave out involves a parent company selling a portion of its subsidiary’s shares to public through an IPO while retaining a majority ownership with them. This creates a legally distinct entity that still maintains a strategic link to the parent company.

- Divestiture: it refers to the sale of a company’s assets or a specific business unit to another organization. It is generally undertaken to streamline operations by concentrating on core activities and disposing of non-core or underperforming segments.

Rationales for demergers

- Risk mitigation: companies can concentrate on areas where they have a competitive advantage by devesting non-core assets, reducing exposure to market fluctuations.

- Value creation: targeted investors attention is drawn to the separate entities and can enhance the shareholders value, as each business is assessed independently according to its own performance.

- Focused strategic direction: companies are allowed to concentrate more their core businesses, which can lead to improved decision making and operational efficiency.

Benefits and challenges of demergers:

Benefits

- Boost in the shareholder value by allowing direct ownership.

- Clear financial reporting and enable investors to assess the performance of individual entities more accurately.

- Can potentially attract new investors due to separating businesses by which company optimize the valuation of different entities.

- Improved operational focus; as independent entities align their strategies and resources solely to meet their specific objectives, it results in greater focus.

Challenges

- It is complex legal and financial restructuring.

- Demerged entities may lose synergies and economies of scale once there shared as part of large organization.

- Division of assets and liabilities within the entities can be complex and can lead to disputes.

- There are probable workforce resistance and internal uncertainty.

- Reverse merger: in this strategy, opportunity is provided to unlisted companies to convert into listed companies by not opting to IPO (initial public offer). Where majority of shares of public company is possessed by private company.

- Disinvestment: it refers to the action of organization or government sells or liquidates an asset or subsidiary. It is also known as ‘divestiture”

- Takeover/Acquisition: takeover means a situation where acquiring company gains control of a targeted company. It is also known as the acquisition. It is usually done by company to gain market supremacy. It can be friendly takeover or hostile takeover.

- Join venture (JV): to under take financial act together an entity is formed by two or more companies. This entity is called joint venture. Agreement is formed by both parties to contribute proportions as agreed to form a new entity also to share the expenses, revenue and control of the company.

- Strategic alliance: agreement between two or more parties to collaborate with each other, in order to achieve certain objectives while continuing to remain independent organizations in called strategic alliance.

- Franchising: agreement where one party grants another party the right to use trade name as well as certain business system and process, to produce and market goods or services according to certain specifications.

- Slump sale: the transfer of one or more undertaking as a result of the sale of lump sum consideration without values being assigned to the individual assets and liabilities in such sales. If a company sells or disposes of the whole or substantially the whole of its undertaking for a predetermined lump sum consideration, then it results in a slump sale.

Amalgamations

Amalgamation is a legal process by which two or more companies are joined together to form a new entity. This refers to the process of merger of two or more companies into single entity or where one company takes over the other by outright purchase.

There are companies involved in the amalgamation called as vendor or transferor company and vendee or transferee company.

Purpose of amalgamation: companies can receive various advantages such as

- Expand market reach.

- Increase competitiveness.

- Diversify operations.

- To improve efficiency.

- Large-scale production.

Types of amalgamation: there are two types of amalgamation

- Amalgamation in the nature of merger

- Amalgamation in the nature of purchase

Amalgamation in the nature of merger is an amalgamation where there is genuine pooling not only od assets and liabilities of the transferor and transferee companies but also of the shareholders interests and of the business of companies.

When following conditions should be satisfied by the amalgamation of amalgamation in nature of merger:

- All the assets and liabilities of the transferor company become, after amalgamation, the assets and liabilities of the transferee company.

- Shareholders who hold not less than 90% of the face value of the equity shares of the transferor company (other than the equity shares already held therein, immediately before the amalgamation, by the transferee company or its subsidiaries or their nominees) become equity shareholders of the transferee company by virtue of the amalgamation.

- The consideration for the amalgamation receivable by those equity shareholders of the transferor company who agree to become equity shareholders of the transferee company is discharged by the transferee company wholly by the issue of equity shares in the transferee company, except that cash may be paid in respect of any fractional shares.

- The business of the transferor company is intended to be carried on, after the amalgamation, by the transferee company.

- No adjustment is intended to be made to the book values of the assets and liabilities of the transferor company when they are incorporated in the financial statements of the transferee company except to ensure uniformity of accounting policies. (icsi.edu)

Amalgamation in nature of purchase is when any one or more of the conditions specified above is not satisfied in an amalgamation, such amalgamations are considered as amalgamation in nature of purchase.

Advantages and disadvantages

Advantages

- Increase in competitiveness, due better resources and strengths sum into better positioning in market.

- Expansion of company, increasing customer base.

- There are certain tax advantages.

- Can increase shareholder value.

- Achieves economies of scale.

Disadvantages

- Can risk to monopoly, as it reduces competition.

- May lead to loss of jobs.

- Could result in a dangerous debt load creating heavy liabilities.

- Bringing companies culture, operations, and management system of the two companies can be challenging.

Schemes of arrangement

Under the Company Act, 2013 Schemes of arrangement is a legal framework provided to a company that allows them to restructure their affairs in order to achieve certain objectives. Company can enter into agreements such as mergers, amalgamations, demergers, acquisitions, or reorganization.

It constitutes a statutory mechanism enabling financially distressed companies to reach binding agreements with the creditors for the debt restructuring, repayment, or reorganization. This scheme process ensures fairness and protection of minority interests, making it a preferred alternative to informal workout arrangements.

It is recognized as the legitimate corporate tools available to the companies facing financial distress. These schemes include various forms of corporate reorganization, including debt restructuring, asset sales, business transfers, and capital reorganization. This scheme binds all the stakeholders, providing certainty and enforceability that informal arrangements may lack.

Procedure:

- Proposal: company formulize a proposal which contains the outline of terms and conditions of the agreement, including the details of the transfer of assets, liabilities, and shareholders’ interests.

- Approval of proposal: board of directors of each company involved, must approve scheme. Then the directors will file a petition with the national company tribunal (NCLT) for the approval.

- NCLT approval: scheme is examined to ensure its compliance with legal requirements and protects the interest of shareholders, creditors, and other stakeholders.

- Meeting: both companies’ shareholders and creditors are presented the scheme for their approval. Majority of the shareholders and creditors must approve the scheme.

- NCLT conformation: after the approval of the shareholders and creditors company applies to NCLT conformation of the agreement. For the fairness and reasonableness NCLT examines the scheme again.

- Implementation: after NCLT approves the scheme, it becomes effective. Companies carry necessary actions to implement the scheme.

- Filing and compliance: companies must file the NCLT conformation order with the registrar of companies (RoC) within the specified time.

Purpose of schemes of arrangement:

- Any company facing financial distress or needing restructuring can propose the scheme of arrangement.

- Provides a legal route for company to address issues.

- It is formal and court approved restructuring process.

- Can settle disputes

- This scheme can adjust the ownership without a full merger or demerger.

Legal framework and Amendments

- The Companies Act, 2013

Various provisions are provided for the agreements, amalgamations, mergers, Demergers, fast track mergers for small companies, cross border mergers, takeovers, corporate debt restructuring. Etc. chapter XV of the companies act, 2013 contains provisions. Following are the provisions mentioned in companies act. (India code)

- Section 230-231 describes about compromise or arrangement.

- Section 232 – mergers and amalgamations including demergers.

- Section 233 – amalgamation of small companies (called as fast track mergers).

- Section 234 – amalgamations with foreign company (called as cross border mergers).

- Section 235 – acquisition and dissenting of shareholders.

- Section 236 – purchase of minority shareholders.

- Section 237 – power of central government to provide for amalgamation of companies in public interest.

- Section 238 – registration of offer of schemes involving transfer of shares.

- Section 239 – preservation of books and paper of amalgamated companies.

- Section 240 – liability of officers in respect of offences committed prior to merger, amalgamation etc.

- Income Tax Act, 1961

Deals with the concept of amalgamating or amalgamated companies, carry forward of losses, exemptions from capital gains tax etc. under the income tax act, 1961, merger is treated as amalgamation only when the conditions laid down are satisfied [section 2 (1B)] (India code)

- All the property of the amalgamating company become the property of the amalgamated company.

- All the liabilities of the amalgamating company become the liabilities of the amalgamated company.

- Shareholders holding not less than 3/4th in value of shares in amalgamating company become shareholders of the amalgamated company by virtue of the amalgamation.

- Competition act, 2002

Mergers and acquisition are termed as combination under competition act. The regulation of combinations is explained under section 6 of the act. Under this act, it is mandatory to submit a notice to the commission of the proposed combination within 30 days of getting approval from the board of directors. Section 29 further outlines the procedure the commission follows for the investigating combinations that may cause an appreciable adverse effect competition. (India code)

- Insolvency and bankruptcy code, 2016

Chapter II of the code mentions the provisions related to the corporate insolvency resolution process (CIRP) that can be initiated by a financial creditor, operational creditor, or corporate debtor itself. In case of failure debtors will undergo a liquidation process, and assets are realised and distributed by the liquidator.

- SEBI and corporate restructuring

Mergers and acquisitions of any listed company are regulated by various regulations incorporated by SEBI, which are securities and exchange board of India 2017, Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018. , Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 [Last amended on July 25, 2022]

Recent Amendments

Expanding the scope of the fast track mergers, on 4-09-2025 the ministry of corporate affairs (MCA) notified the companies that it allows the mergers between unlisted companies, holding-subsidiary combinations, and subsidiaries of the same group, streamline approvals through regional directors instead of tribunals (SSC online)

Key aspects

- Following are the additional classes are included under rule 25 for availing the fast-track merger/demerger procedure

- Two or more unlisted companies (excluding section 8 companies) that meet the prescribed thresholds of outstanding loans, debentures, or deposits.

- Holding company and its subsidiary, provided the transferor company is not listed.

- Two or more subsidiaries of the same holding company, again excluding cases where the transferor is a listed company.

- Old forms are replaced and new forms are introduced:

- CAA – 9: it is for notifying the proposed scheme and inviting objections.

- CAA – 10: solvency declaration.

- CAA – 10A: for financial compliance an auditor’s certificate is required.

- CAA – 11: involves filing the approved scheme along with the results of the meetings and valuation report.

- If companies opt for fast-track route under the new law, then it is required to submit a certificate from the auditor in the form CAA-10A which conforms:

- There should be no defaults in replaying the loan, debentures, or deposits,

- And all the outstanding amount should remain within the ₹200-crore limit.

- If company is regulated by (RBI), (SEBI), (IRDAI), (PFRDA), or listed the company should:

- Send the scheme notice to the relevant regulator and stock exchange.

- Address any objections or suggestions received.

- Transferee company will file:

- Copy of approved scheme.

- Shareholders and creditors meeting results.

- Attached form of RD-1, valuation report in form CAA-11.

- If applicable a statement that explains how objections were resolved.

- Applicability to schemes involving:

- Division or transfer of undertakings under section 232(1)(b).

- Government can apply relevant provisions from section 232(3)(a) to (j).

- New format for CAA-12 form is introduced or issuing the government’s conformation order of the scheme.

Conclusion

Either by demergers, amalgamations, scheme of arrangements, corporate restructuring emerged as a vital mechanism to companies to navigate the competitive pressure, regulatory changes, and evolving market dynamics. This helps business to achieve long terms goals. To thrive in today’s competitive market, it is necessary to understand the types of corporate restructuring and their applications. Each route of restructuring serves a distinct strategic purpose: demergers help companies to focus and create value; amalgamation enables a company to expand, synergy, and operational efficiency; and scheme of arrangement is a supervised court framework capable of addressing complex financial or organizational challenges. With the right restructuring strategy organization can unlock a company’s full potential.