This article is written by Mr Vineet Vishal of Lloyd school of Law during his internship with Le Droit India.

- Basic introduction of M&A

The term M&A means Mergers and Acquisitions, its is very important thing in a business world or in a corporate world, it helps in expansion of the company by merging any other company under it.

By the help of merger and acquisitions the two and more than two companies merge themselves and build a new company under the companies act 2013, or by acquiring the other companies by purchasing the majority of the shares, for the expansion, increasing their market share, having cost efficiency in the company or reducing competition in the market.

It is the main role or we can say use of the M&A in the business world.

- Basic introduction of Zee Telefilms.

Zee telefilms which now becomes zee entertainment enterprises limited ZEEL. It was started by Subhash Chandra in 15 December 1991, they launched the first satellite channel called as ZEETV in 1992, the vision of Subhash Chandra is to build a private Hindi entertainment company, Zee Telefilm’s started a new era of television industry.

- Basic introduction of Sony Entertainment.

Sony Entertainment Television [SET] is an Indian Hindi television channel which creates shows which are usually family oriented comedy, drama, reality shows. It is famous for this in India, they started their operation in India from october1995.It is run by Sony pictures India which is part of Japan based company Sony group corporation.

- After understanding the basics of M&A and background of the both of the companies lets go further on the case of merger and acquisition of ZEEL and SET 2021 and discuss each and every single aspect of the case.

- Background of the Case .

- As all know Zeel is a giant of the Hindi television but in 2018 Zeel facing the financial crisis because the parent company of Zeel which is Essel is under debt of more than 13000cr because they started there some new projects of Infrastructure and funds which became huge flop so, the head and founder of Essel group Subhash Chandra in 2019 drop the promoter stake of the group from 41% to 4% which means Zeel became promoter less.

- Then Invesco which is Usa based fund company who have the 18% of stake comes in and demand to board of director to remove Punit Goenka from its post they think that he does not have the leadership quality which the company needs the most. Then in September 2021 Sony comes in and gives the proposal to merge the company with them.

- Idea of merger

- The merger of Zee and Sony was the biggest merger of a media deal in India which is announced in 2021. There aim was to became a big media entity and to give tough competition to the big market player like Netflix Amazon prime and Hotstar in India all the things of merger going very smoothy at the time when it was announced and the market expert are consider it as game changer at that time.

- Structure of Merger

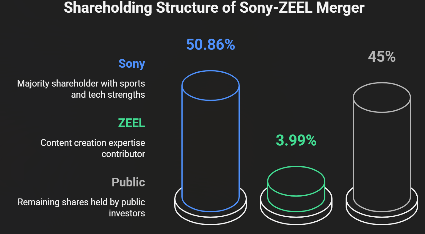

- Zeel and Sony both decided together that Sony pictures network [SPN] will invest 1.575 billion $ in Zeel after that Sony have the holding of 50.86% in the company and Zeel promoters holding will be 3.99% in the company and remaining shares will be public shareholders, and they became big entertainment giants in India and they decided the name Culver max entertainment.

- The MD of Sony Mr N.P Singh said that both the company strength should be combined and zee works in content creation and Sony deals sports entertainment and both of them have combine 75+tv channels and 2 Ott platforms to run.

- Regulatory Delays

Now the real story begins of this case at the time when the merger is firstly announced everyone is thinking that the merger will take place very smoothly but is doesn’t happened as they think then real problem started with the approvals.

Role of CCI [Competition Commission of India] in this Case.https://ledroitindia.in/competition-law-issues-in-mergers-role-of-cci-in-india/

CCI which stands for competition commission of India, CCI main work to ensure fair competition in the market.

- In this case CCI thinks that both the companies after merger with each other holds a stronger position in the market especially in entertainment and advertisement sector, so that in the initial stage CCI setup the in Depth investigation before giving the approval.

- In august 2022 CCI given its final approval but with certain conditions, the conditions are monopoly and unfair practice should not be there and they don’t disrupt the market competition for their own benefits.

- Role of SEBI [Securities and Exchange Board of India] in this Case.https://indiankanoon.org/doc/1365176/

- SEBI stands for securities and exchange board of India. It is a Government

- based Organizations and its works is to regulate the share market of India.

- SEBI have the concern on going of financial Irregularities against the promoters. There are some allegations of Essel group which is the promoter of zee that they have misused the funds of the company.

- SEBI had taken strict action against Subhash Chandra and Punit Goenka who are the promoter of zee and said that till the investigation is in process both of them are removed from their respective posts.

- It became the obstacle for the mergers because they are considering Punit Goenka as the CEO of the new venture of the company, because of this reason that SEBI order that MR Punit Goenka cannot work as a director or he can not work on any managerial position including merger company Sony loses its trust on zee and cancel the merger in January 2024.

- Role of NCLT [National Company Law Tribunal ] in this case.

- NCLT is a special court which deals with the matters related to company

Disputes like insolvency, merger, mismanagement and resolve them. NCLT also known as judge of company matters.

- NCLT is final legal body where the merger’s final legal sanctions were done, it means that when all the approval and regulations were passed then company give application to NCLT for the final order.

- When SEBI case is in process at that time NCLT hold the case of merger and because of that Sony loses its patience because of delays and they have breach of trust on Zeel that’s why in January 2024 they cancel the merger deal with Zeel, and Sony said that their merger terms were not fulfil and they taking exit from this deal.

- Post Merger Collapse.

- Zee stock crashes more than 30% in one week.

- Zee claims 90million$ penalty on Sony in arbitration court of Singapore

- Zee shareholders lose the trust on Punit Goenka and he is still the CEO of zee, and there is uncertainity in the future plans of Zee.

- Lessons for Future M&A after this Case

- Due Diligence is Everything.

In the beginning Sony had done due diligence but there only is mistake is that they don’t check the promoter related issue deeply. For future M&A it is a lesson that they must check the promoters background, all the financial records and regulatory pending issues, otherwise it creates huge impact on the M&A deals.

- Regulatory Risks should be Anticipated.

The role of CCI SEBI and NCLT are very important and crucial, if their rules were not clear and any case is pending then at that time deal can be paused. Companies should consider their approval, timelines and risk factor before planning mergers.

- Leadership Clarity should be there.

In the merger deals the leadership transparency must be there or there must be a backup of a leader, in this merger Punit Goenka is becoming the MD&CEO of the company but when Sebi introduced allegation Punit Goenka then Sony getting trust issues on Punit Goenka that’s why there should be a backup of leadership for the benefit of the company.

- Time is money

This merger deal taken 2 years for the completion but at last the deals is canceled, which harm the time of market and also loses the trust on the company, it also damages the brand name and image of the both the companies. In my opinion there must be some time bound clauses are there to minimize the delays of deals of merger.

- Conclusion

Zee and Sony merger is potential and blockbuster deal if it became successful then it change the future of media in India but due to some conflicts this deal a failure so we can also say that the merger is not only the game of numbers it is also a game of transparency trust and timing.